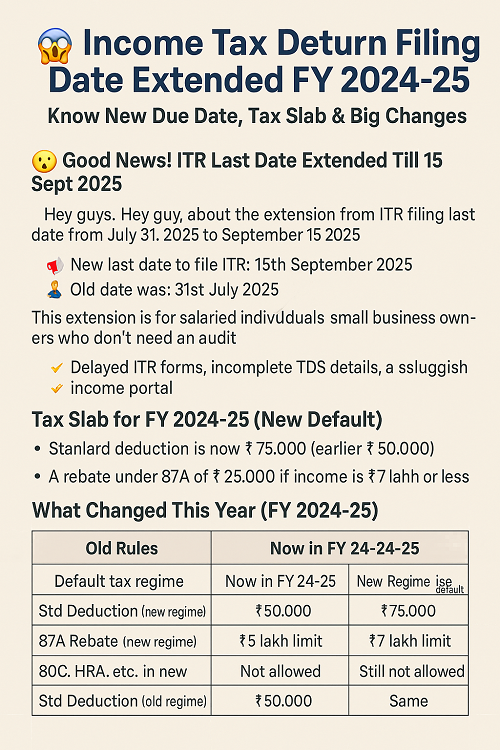

Good News! ITR Last Date Extended Till 15 Sept 2025

If you still didn’t file your income tax return (ITR) yet, don’t worry! Income Tax Return Filing Date Extended from 31 July 2025 to 15 September 2025.

📢 New last date to file ITR: 15th September 2025

Old date was: 31st July 2025

This is mostly for salaried people, small business owners and those who not need any audit.

Why they extended? Because:

- New ITR forms came late

- TDS details not showing fully

- Income portal was bit slow also

📊 Tax Slab for FY 2024-25 (AY 2025-26)

Govt is giving us 2 options for tax — old regime and new regime (this is now default).

✅ New Tax Regime (Default Now)

| Income Range (₹) | Tax Rate |

|---|---|

| 0 – 3,00,000 | Nil |

| 3,00,001 – 6,00,000 | 5% |

| 6,00,001 – 9,00,000 | 10% |

| 9,00,001 – 12,00,000 | 15% |

| 12,00,001 – 15,00,000 | 20% |

| More than 15,00,000 | 30% |

👉 Standard Deduction now: ₹75,000 (earlier was ₹50,000)

👉 Rebate under 87A: ₹25,000 if your income is ₹7 lakh or less

💸 Means up to ₹7.75 lakh income = no tax at all

📚 Old Tax Regime (if you choose manually)

| Income Range (₹) | Tax Rate |

|---|---|

| 0 – 2,50,000 | Nil |

| 2,50,001 – 5,00,000 | 5% |

| 5,00,001 – 10,00,000 | 20% |

| More than 10,00,000 | 30% |

👉 Standard Deduction: ₹50,000 only

👉 87A Rebate: ₹12,500 if income is up to ₹5 lakh

📝 So here, no tax till ₹5.5 lakh income

🔁 What Changed This Year (FY 2024-25)

| What Changed | Earlier | Now in FY 24-25 |

|---|---|---|

| Default tax regime | Old Regime | New Regime is default now |

| Std Deduction (new regime) | ₹50,000 | ₹75,000 |

| 87A Rebate (new regime) | ₹5 lakh limit | ₹7 lakh limit |

| 80C, HRA, etc. in new | Not allowed | Still not allowed |

| Std Deduction (old regime) | ₹50,000 | Same |

✍️ Some Things to Keep in Mind Before Filing ITR

- ✔️ Choose right tax regime for you

- ✔️ PAN and Aadhaar must be linked

- ✔️ Check your income and TDS from Form 26AS and AIS

- ✔️ File before deadline to avoid late fine

⚠️ If You File After 15 Sept 2025

| Filing Date | Penalty (Under 234F) |

|---|---|

| Till 31 Dec 2025 | ₹1,000 to ₹5,000 |

| After 31 Dec 2025 | Not allowed unless notice received |

❓ FAQs (People Always Asking)

Q1. ITR last date really extended?

👉 Yes bro, now it is 15 September 2025 officially.

Q2. Is standard deduction really ₹75,000 now?

👉 Yes in new regime only. In old, it is still ₹50,000.

Q3. Can I switch tax regime?

👉 Yes, salaried people can choose different one every year.

Q4. No tax if income is ₹7 lakh?

👉 Yes, and with ₹75,000 standard deduction, even ₹7.75 lakh is tax-free.

Q5. I earn less than ₹2.5 lakh, should I file?

👉 Not compulsory, but better if you want refund or loan/visa later.

📝 Disclaimer

I tried to give correct info as per latest update till 23 June 2025. But rules can change. So pls double-check once on https://incometax.gov.in.